This post was written May 12, 2014 by Anton Reed '14 for Economics 244. The Prof edited it and appended comments by others in the class.

I will revise and reblog the best posts of my students over the coming weeks.

In April, when they released their FY2013 annual results, MMC (Mitsubishi Motors Corp) reported record profits. Don't get too excited.

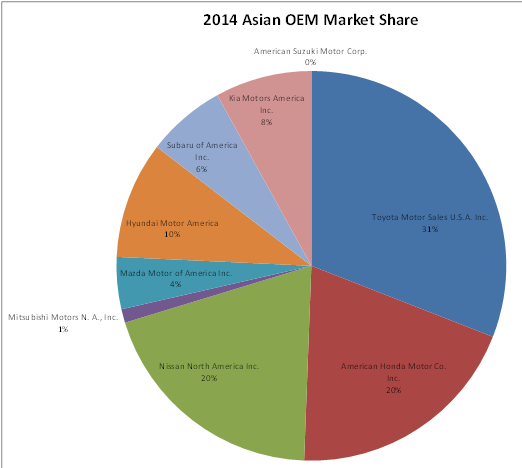

Mitsubishi Motors' North American operations are struggling; MMC sells far less than any other Asian car company in North America. The next smallest, Mazda, sold almost three and a half times as many vehicles in April 2014. Only six firms sold fewer cars, and of those only Volvo is not a niche luxury marque. (The other five, in decline order of sales, are Jaguar/Land-Rover, Porsche, Tesla, Maserati and Ferrari.)

There are positive signs, with April sales up 46.6% over 2013 and year to date sales up 29%. Only Maserati had a larger increase, but they sold 753 vehicles last year, so that shift represents only a few additional cars. On the other hand, among manufacturers building cars for mainstream customers, Mitsubishi sells the least, so its percentage increase likewise represents only a modest absolute change. Nevertheless Mitsubishi has been improving its North American operation, with net sales up 53% from 2012 to 2013.

Such sales however mean that MMC's Illinois plant – begun in 1988 as Diamond-Star during the era when Chrysler was a major shareholder – continues to operate in the red. Whether or not Mitsubishi will be able to mount a comeback from the brink of essentially complete failure in North America will depend heavily on the continued expansion of their share and the overall vehicle market. Summer sales are expected to be substantial enough to grow the car market in 2014 over 2013, but that increase won't be enough to float MMC. Mitsubishi will likely see its sales cannibalized by the other automakers and go the way Suzuki, Isuzu and Daihatsu, Japanese firms that have completely withdrawn from North America.

Sources: www.motorintelligence.com and www.mitsubishicars.com. Sales graph on right added by the Prof.

STUDENT COMMENTS / DiSCUSSION

Louis Ike · I do not see Mitsubishi making much of a resurgence in sales here in North America. The number of dealerships around any one geographic location is much lower than its competitors, and this only mimics the pattern of low sales volume. The cars that Mitsubishi is currently making, to put it simply, do not fit the consumer preferences of the modern North American. In my opinion, Mitsubishi needs a serious rebranding because its public image is one of cheap, ugly, and obsolete vehicles.

Now however do consumers even know (much less care!) that MMC is a “Japanese” company? Or that the vehicle was made inside NAFTA, or imported from Japan / Korea / Europe? It’s an empirical question, and the surveys I've seen suggest consumers no longer care about national identity and import status, though "Munroney sticker" legislation mandates manufactures provide those details on the window sticker found on all new cars. See my thoughts on MMC here: Mitsubishi Motors: going, going … gone?